Applying technologies to finance processes is still in the early stages for many organizations, the CFO can lead the way to increased efficiency, insights, and business value over the long-term. A mistake often made is, starting with automating before streamlining end-to-end processes.

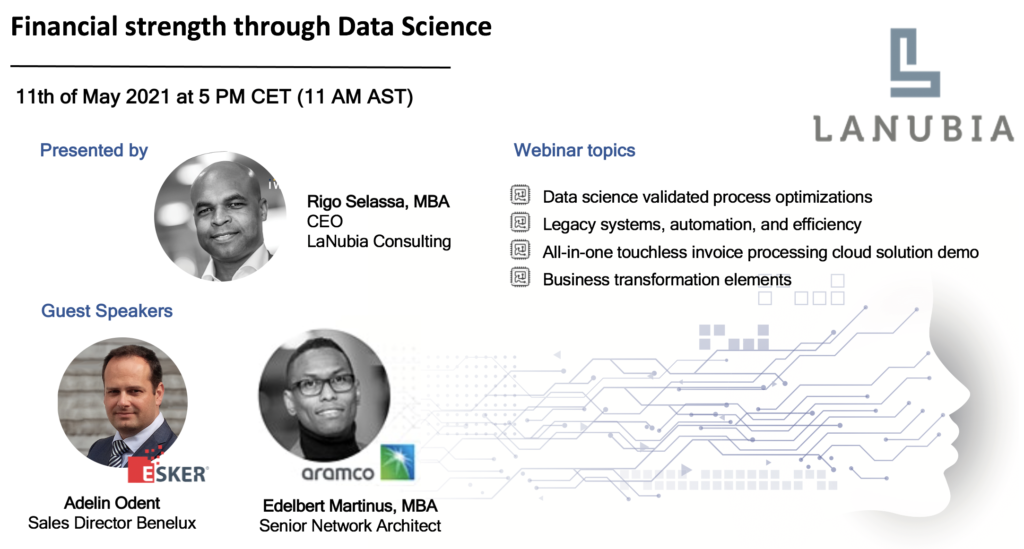

Join our webinar where we will share our decades of top-tier Consulting, Data Science and best-practice experiences. We present the end-to-end approach towards financial process optimization and we will go through several technological options and the steps organizations should take, in the right chronological order

LaNubia uses advanced statistical Data Science methods to create insights based on benchmarking best practices, analyzing vast amounts of data, and detecting the activities in the process flows that cause bottlenecks.

The Accounts Payable department is where many organizations are struggling with slow processing, purchase order (PO) matching errors, contaminated and incomplete master data, inaccurate and lengthy closes, missed vendor discounts and penalties, limited control and visibility of processes etc. With the right streamlining practices and mix of technologies many problems can be solved simultaneously. The CFO needs to get in front of digital finance, proactively and systematically identify tasks and processes within the finance function that would benefit most from digitization.

LaNubia helps clients with a new type of analysis, dissecting process flows into a large number of detached tasks and assess how easily each task can be automated and which technology would be best suitable to perform that task. Solving the department’s day-to-day and long-term objectives by prioritizing cost reduction goals, error-prone manual challenges, and liquidity problems. Creating room for a solid working capital strategy to determine capital growth, cost reduction opportunities, improve services, and capture investment opportunities.

With Data Science we are able to assess complete end-to-end financial processes from a bird’s eye view, which is cross functional, adds long-term value and insights, that go beyond the finance department.

Join our webinar and get to know how we help clients with process optimizations answering essential questions such as:

- How can finance departments capitalize on lean process optimizations and data science analyses?

- What, when and how to consider automation technologies to truly capitalize on investments?

- How can the purchase order (PO) mismatch and legacy system problems be tackled?

- How to improve supplier relationships and free working capital?

- What aspects should be considered when choosing technological solutions such as: cloud platforms, robotic process automation (RPA), and machine learning practices?

- What have other companies gained from process optimization technologies in terms of cost, time and effort reductions?

Interested and want to learn more? Click on the banner below and register NOW!

For more information about this subject or the webinar you can contact Mandana Teimori directly at Mandana.Teimori@lanubia.com