1.Streamlining financial processes

Organizations may be more effective if financial processes are streamlined and if applications are partially eliminated instead of transcribed into systems directly. Streamlining starts with questioning, why activities are performed the way they are, to then deploy a workflow system to simplify information flows.

It is better to look at financial processes end-to-end across multiple departments versus the traditional approach of assessing processes within the finance department silo. Advancing continuously requires detection of bottlenecks and pain points, data science allows for processing and benchmarking fasts amounts of data. Being able to establish improvement metrics and goals, the tracking of progress and the ability to act quickly when operations do not go according to plan. Leading to the elimination of complexities through standardizing financial processes and therefore improving overall effectiveness of the finance department. Exceptions and special cases add cost without value, standardizing makes automation efforts more efficient and sustainable.

2.The right involvement and governance

Achieving success with automation often derives from the involvement of IT in the early stages of the process. Organizations can increase the chances of successful automation implementations however, by engaging management from all stakeholder groups in early stages such as finance, IT, operations, human resources and more. Because automation will significantly change the way people work, it is important to involve all teams that will be affected and engage them in the early stages of the conversations, to clarify what is in it for them.

The collaboration and communication between IT and the teams working with the new technologies is just as important as a bespoke governance and oversight. If the conversations between the IT and the involved parties are held and guided in the early stages of the change, it may significantly reduce iterations and complications of processes in later stages of the automation. Allowing for a smoother running governance process.

3.Communication and commitment

Change is teamwork. Executive teams should have sufficient knowledge to lead the adoption of automation, focusing on deploying their talent pool more effectively. Communication is one of the most valuable expertise leaders hold, no idea, plan, vision, skill, or practice can become a reality if leaders are not able to make thoughts more tangible through actions and words. Committing to both their automation goals and their teams, expands growth potentials.

It is essential that leaders understand the power of company culture through two dimensions: how people interact (interdependencies) and their response to change (flexibility to stability). With these oversights leaders can detect the needs of their teams and support them throughout and after automation processes.

4.Create capabilities

The emphasis on people should be as much if not more than on the new technology. Starting with assessing the capabilities and tolerance for change of the teams increases the chances of a successful implementation. It creates the pathways to address potential automation-related skill and cultural gaps on time. Assisting your finance team through change means providing both the soft- as well as the hard skills support and training, to accomplish the organizational and automation goals.

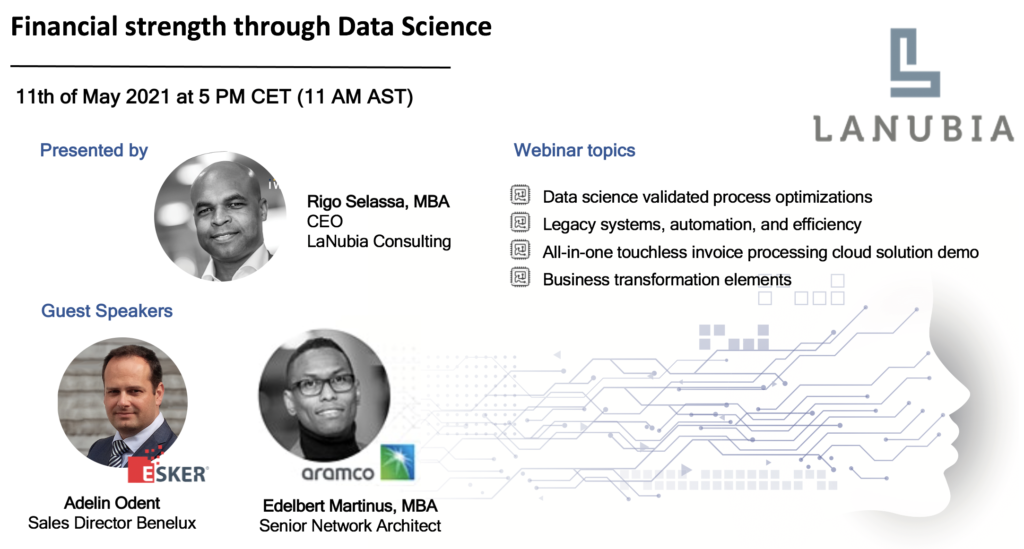

Interested to learn more about obtaining financial strength within your organization? Click on the below image and subscribe NOW for our webinar on 11 May 2021.

For more information about this topic you can directly contact Mandana Teimori via Mandana.Teimori@lanubia.com .